Growth & Scale Offering

Enhancing A Trusted Banking Company’s Online User Experience

Every day, thousands of banks rely on this trusted banking network and its online portal to manage capital, find funding for loans, diversify accounts, and process reciprocal deposits. The user experience (UX) they have may be the most important factor in whether these financial institution customers believe the value they receive measures up to the fees they pay. If they can’t easily navigate and process information, they may look to do business elsewhere—no matter how well things work on the backend.

This financial institution engaged with 3Pillar Global to improve their online portal UX and enhance the customer experience (CX) they deliver while alleviating pressure on their internal team and helping them to improve their software development processes.

Challenge

Expand Expertise to Deliver a Better Customer Experience

The client’s internal teams specialize in back-end software development, business analysis, and product management. But they needed additional resources and expertise to design and build an easy-to-use experience for customers using their online portal. They also needed help building integrations to automate the exchange of data with customers.

They brought 3Pillar Global on board not only because of our proven expertise in software development and building satisfying customer experiences, but also because we brought a solid understanding of their business model as well as the IT processes involved in delivering services to customers. We also showed how we could adapt easily to change and proactively bring innovative ideas to the table that enhance the user experience.

Solution

Support Customers with Easy-to-Use Portals and Real-Time Data

Because of outdated legacy code, the existing portal lacked important functionality, forcing customers to jump through a lot of manual hoops to make the application do what they wanted. 3Pillar mitigated this gap by creating a clear set of requirements for reducing friction points and automating integration. This enabled the software development team to quickly roll out new features. Customers can now easily access and use the application through customized portals—without the frustration of tedious, manual workarounds.

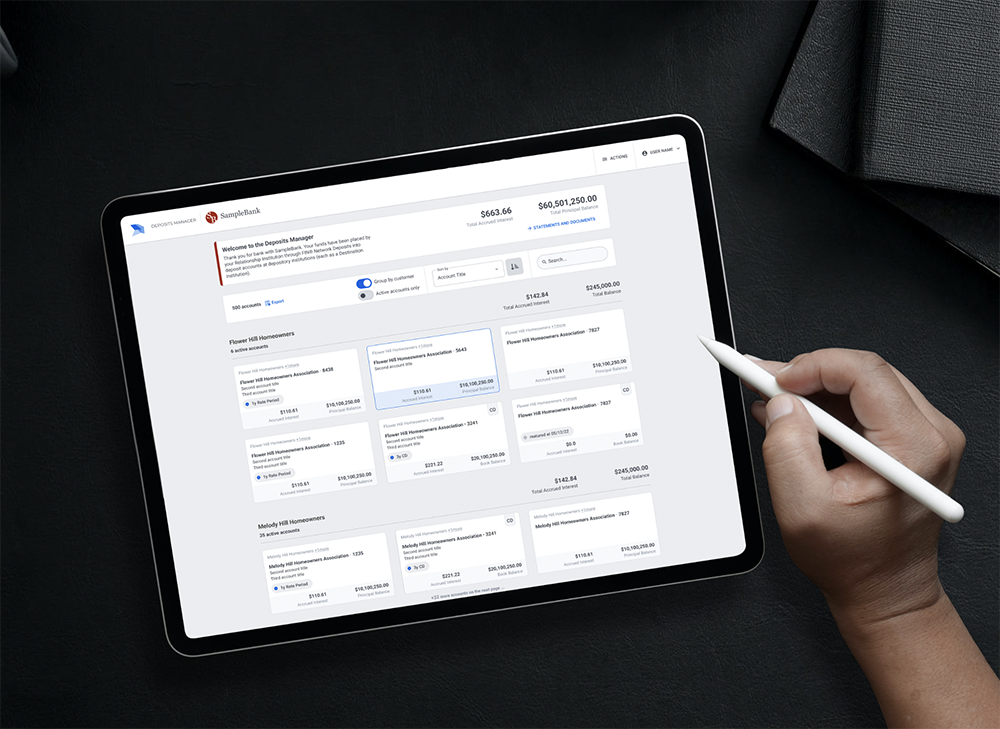

Rebuild Depositor Control Panel and Make It Easier to Manage Accounts

Based on our successful partnership and progress on the online portal enhancements, the financial institution also engaged 3Pillar to rebuild their legacy on-prem Depositor Control Panel (DCP) as a cloud-native application, enhancing the features and functionality to make it more user-friendly, secure, reliable, and flexible—and give bank customers a better tool to manage their accounts.

They saw the project as an opportunity to learn the best way to build and maintain a cloud-native application—and then make informed decisions on migrating other on-prem applications to the cloud.

The new DCP has greatly improved the end-user experience, giving depositors visibility into account balances, accrued interest, current balance placements, and where balances could be placed in the future. It also enables them to reject pending placements through a periodic depositor placement review.

Key CX improvements:

- Allow depositors to self-register online.

- Eliminate the need for bank customers to visit bank branches.

- Remove the need for multiple logins for a single customer with multiple accounts.

- Improve UX through better site organization, user flows, and enhanced graphics.

- Improve accessibility by implementing WCAG 2.1 level AA compliance guidelines.

- Make each web page printer-friendly to support customer needs.

We’re now creating better integration with their customer systems, including automated data exchanges. This will eliminate the time spent on manual data entry while providing access to real-time information.

Enabling Teams to Deliver Business Value Faster

3Pillar also delivered technical improvements that modernized and unified the tech stack and code base. This supported the overarching goals of enhancing the customer experience and enabled the internal team to streamline software development and deliver business value faster.

- Provides code that’s easier to use, understand, and maintain.

- Updates coding practices to meet current standards.

- Automates testing and deployment.

- Maintains a strict priority on minimizing bugs and maximizing business value.

Outcome

Fostering a Culture of Innovation

As these projects progressed, the banking organization discovered that 3Pillar product analysts eased pressure on their internal business analysts by helping them understand the requirements and working with internal product managers to understand the vision for user experiences. This gives software developers a clear picture of what to deliver and speeds up the application delivery lifecycle.

More importantly, though, our team has fostered a culture of innovation by recommending creative ideas to improve how the business runs and how they interact with customers. With 3Pillar involved in the planning process, they have been able to revamp their roadmap for modernizing applications, continually enhancing customer services.

The partnership with 3Pillar has expanded over time across multiple products and engagements, and our high-performing team members are now viewed as an extension of the institution’s own development organization.

“The 3Pillar team is a true partner to us, and I see them as an extension of our internal development team that is seamlessly integrated. They bring process, structure, and expertise to our team and not only deliver the results we need, but also make us a better team overall.”

— Banking Network CTO